Introduction

In recent years, the automotive engineering services market has been undergoing rapid transformation. As vehicle manufacturers grapple with rising consumer demands, changing regulatory landscapes, and accelerating technological innovation, engineering service providers are increasingly called upon to deliver more than mere design support. Indeed, they are expected to contribute in areas such as electrification, autonomous driving, lightweight materials, connectivity, and software-defined vehicles. Furthermore, supply chain constraints, sustainability imperatives, and global competition are adding new layers of complexity. Consequently, the automotive engineering services sector is evolving—not only in capability but in scope, scale, and strategic importance. In this article, we explore the evolution of these services; identify current market trends; analyze the challenges; evaluate market scope; estimate market size; and, finally, enumerate the factors propelling growth. Overall, this post aims to offer a comprehensive, readable, and insightful guide for stakeholders wishing to understand where the automotive engineering services market stands, how it got here, and where it is headed.

Source: https://www.databridgemarketresearch.com/reports/global-automotive-engineering-services-market

The Evolution of Automotive Engineering Services

Over time, automotive engineering services have evolved from traditional design and drafting roles to encompass a wide range of multidisciplinary capabilities. Initially, engineering services mainly meant body design, chassis development, and powertrain optimization. Early vehicle platforms relied heavily on mechanical systems, simple electrical architectures, and conventional combustion engines. Thus, engineering firms focused on component design, structural analysis, prototyping, and validation using mechanical testing.

However, as regulatory standards became more stringent—especially regarding emissions, safety, crash-worthiness, and fuel efficiency—automakers began to demand more sophisticated engineering inputs. Consequently, simulation tools, computational fluid dynamics (CFD), finite element analysis (FEA), and virtual prototyping became more central. Moreover, engineering service providers started to integrate software engineering, electronics, and embedded systems into their offerings.

Furthermore, the advent of alternative powertrains—hybrid, battery electric, fuel cell—introduced new challenges in thermal management, energy storage systems, power electronics, battery safety, charging infrastructure compatibility, and lightweight materials. Accordingly, engineering services expanded into domains such as battery pack design, electric motor design, thermal systems, and grid integration.

Moreover, autonomous driving and driver-assist systems added yet another layer of complexity. Sensor integration, perception software, artificial intelligence, safety validation, redundancy, and cybersecurity became essential. Thus, engineering service providers had to invest in new competencies, partnerships, and R&D.

In addition, connected car technologies required engineering services in infotainment, telematics, over-the-air updates, cloud connectivity, user experience (UX), and human-machine interface (HMI) design. As such, the lines between automotive engineering, software engineering, electronics, and user experience blurred.

Meanwhile, lightweighting — the use of advanced materials such as high-strength steel, aluminum, magnesium, carbon fiber reinforced plastics (CFRP), and composite materials — became critically important to improve fuel economy or extend electric vehicle (EV) range. As a result, structural engineering services expanded into materials engineering, joining forces with suppliers and R&D labs to develop and validate lighter, stronger, and cost-effective parts.

Therefore, whereas engineering services were once viewed as supplementary, they are now viewed as central to the entire vehicle development lifecycle. Accordingly, engineering firms are transforming from component designers into full system integrators, collaborating closely with OEMs (original equipment manufacturers), Tier 1 and Tier 2 suppliers, software vendors, and regulatory bodies.

Market Trends

Moreover, several key trends are currently shaping the automotive engineering services market. Indeed, these trends define how engineering services are being structured, provided, and consumed. Below are some of the most prominent among them:

Electrification and Powertrain Shift

Automotive engineering services are being increasingly oriented toward electric powertrain development, battery systems, power electronics, thermal management for EVs, and charging infrastructure integration. Because of government incentives and rising demand for EVs, service providers are investing heavily in these areas.Autonomous, Advanced Driver Assistance Systems (ADAS), and Safety Features

Furthermore, ADAS, sensor fusion, LiDAR/Radar/Camera integration, perception algorithms, and autonomous driving software are becoming central. As safety regulations tighten, validation and verification of these systems are critical. Thus, engineering services now include simulation of perception systems, scenario-based testing, virtual validation, and safety protocol compliance.Software, Connectivity, and Digitalization

In addition, connected vehicles and over-the-air (OTA) updates demand robust software architectures. Infotainment systems, cybersecurity, telematics, HMI UX/UI design, cloud integration, and IoT connectivity are trending upward. Therefore, engineering services increasingly encompass digital engineering, software development, and system integration.Lightweight Materials & Structural Innovation

On the structural side, lightweighting using strength-to-weight-optimized materials is a trend. Composite materials, aluminum, magnesium alloys, advanced high-strength steels, and multi-material design are more frequently used. Engineering services now involve materials selection, joining technologies, crash energy absorption design, and corrosion resistance.Simulation, Virtual Prototyping, and Digital Twins

Moreover, simulation tools, virtual prototypes, and digital twin technologies are being adopted to reduce development cycles, cut cost, and improve reliability. These enable early detection of design flaws, virtual testing under varied environmental and loading conditions, and optimization before physical prototypes are built.Sustainability, Emissions, and Regulatory Compliance

Also, stricter environmental laws, carbon emissions targets, lifecycle assessment, recyclability, and end-of-life vehicle requirements are pushing OEMs to demand engineering services that help reduce emissions, lower carbon footprint, and ensure compliance. Engineering service providers are thus providing life cycle analysis, sustainability consulting, and compliance engineering.Global Outsourcing & Regionalization

Additionally, many OEMs and suppliers are outsourcing engineering tasks to specialized firms in regions with lower cost, while retaining strategic R&D locally. However, regional localization is also growing—for instance, setting up local engineering centers to be close to production plants, suppliers, and customers. Thus, the geography of engineering services is dynamic.Integration of Artificial Intelligence & Machine Learning

Beyond traditional simulation, AI/ML are being used for predictive maintenance, anomaly detection, design optimization, sensor data fusion, and autonomous system training. Engineering service firms are hiring data scientists, partnering with technology companies, and embedding AI capabilities into their offerings.Flexible / Agile Development Methods

Lastly, automotive programs are moving toward more agile and iterative approaches. Instead of rigid waterfall-style vehicle programs, modular architectures, over-the-air updates, and incremental feature rollouts require engineering services that are more flexible, adaptable, and responsive to market changes.Cost Pressures and Value Engineering

Because competition is fierce, OEMs are demanding not only innovation but cost effectiveness. Thus, engineering service providers are more often being asked to deliver value engineering, cost-optimized designs, and reduction in time to market, without sacrificing quality or safety.

These trends together reflect an automotive engineering services market that is increasingly complex, interdisciplinary, software-centric, and focused on sustainability and speed, while also strongly cost-aware.

Challenges

Nevertheless, despite these positive and accelerating trends, the automotive engineering services market encounters significant challenges. Addressing these challenges is essential to sustaining growth and achieving competitive advantage. Below we discuss the major obstacles, along with insights on why they persist and how they may be mitigated.

Rapid Technological Change and Skill Gaps

As technologies like electrification, autonomy, AI, connectivity advance fast, engineering firms struggle to keep pace. Recruiting and retaining talent in software engineering, ADAS, cybersecurity, and battery engineering is difficult. Thus, skill shortages are common. Moreover, continuous training and investment are required, which add cost and risk.High R&D and Validation Costs

Developing systems for safety, emissions, durability, crash, ADAS, and autonomous scenarios requires extensive testing, validation, and simulation. Physical prototypes, durability tests, sensor calibration, crash testing etc., are expensive. Furthermore, regulatory certification is time consuming. These factors increase up-front investment and risk.Regulatory Uncertainty and Compliance Complexity

Laws and standards across regions differ and evolve—especially regarding emissions (CO₂, NOx), safety, crashworthiness, battery safety, cybersecurity, data privacy, and autonomous vehicle regulations. Consequently, engineering service providers must navigate a patchwork of compliance requirements. Regulatory uncertainty can lead to delays and increased costs.Cost Pressure from OEMs & Suppliers

OEMs often push engineering service providers to reduce cost, shorten lead times, and improve quality. As competition among service providers intensifies, margin pressures increase. Lower cost geographies offer alternatives, which may undercut pricing. Thus, maintaining profitability while investing in new capabilities is challenging.Integration Complexity

Integrating hardware, software, sensors, connectivity, mechanical systems, and materials into cohesive, safe, reliable systems is increasingly difficult. Issues such as software/hardware interface compatibility, latency, real-time performance, data security, fail-safe mechanisms, and calibration must be addressed. Mistakes can lead to recalls, safety issues, or regulatory penalties.Supply Chain Disruptions and Component Shortages

Automotive supply chains have become global and complex. Component shortages (for semiconductors, rare earths, battery materials), logistic disruptions, trade policy changes, tariffs, and geopolitical tensions can cause delays in projects. Engineering services, which depend on inputs, testing hardware, components, and materials, are vulnerable.Unpredictable Consumer Preferences & Market Demand

Consumer demand is shifting—for electric vehicles, for more connectivity, for different vehicle types (SUVs vs sedans), for ride-sharing, for affordable autonomy. Forecasting which features, technologies, or powertrains will dominate is difficult. If engineering services invest heavily in one area that does not materialize, there is risk of stranded capabilities.Cybersecurity and Data Privacy Risks

Vehicles are increasingly connected, collecting data and exchanging information. Therefore, potential vulnerabilities exist. Engineering services must build secure architectures, protect firmware and software, guard user data, and ensure resilience to hacking or attacks. This adds complexity, overhead, testing, and regulatory burden.Cost of Transition (Legacy vs New Architectures)

Large automakers have existing platforms, supply chains, and production tools. Shifting to new architectures (modular platforms, EV powertrains, software-defined vehicles) implies transitioning costs. Engineering service providers must support both legacy and new systems, which increases complexity and cost.Environmental & Sustainability Constraints

Finally, increasing expectations from consumers, regulators, and society demand lower emissions, sustainable materials, recyclability, and circular economy considerations. Meeting these demands often increases cost, complicates materials selection, and raises lifecycle assessment burdens. Engineering services providers must factor in these constraints from design stage onward.

Market Scope

The market scope of automotive engineering services is broad and continues to expand. Accordingly, understanding the full range of application areas, service types, geographic segmentation, value chains, and customer types is crucial to discern where opportunities lie.

Application Areas

Powertrain & Drivetrain Engineering: Internal combustion engines, hybrid powertrains, electric motors, transmission systems, power electronics.

Battery and Energy Storage Systems: Battery pack design, thermal management, cell chemistry, safety, charging interface.

ADAS and Autonomous Systems: Sensor suite integration, perception algorithms, mapping, localization, driver assistance features, autonomous driving functions.

Safety & Crash Engineering: Crash structure design, occupant protection, pedestrian safety, regulation compliance, crash simulation.

Body & Exterior Engineering: Aerodynamics, lightweight materials, styling, materials selection, paint and coating.

Chassis, Suspension & Steering: Ride comfort, dynamics, handling, steering feel, NVH (noise, vibration, harshness).

Electrical/Electronics & Software: ECU design, embedded software, connectivity, infotainment, cybersecurity, over-the-air updates.

Interior & HMI / UX / Infotainment: Touch screens, displays, audio systems, user experience, ergonomics, interior materials.

Thermal Management & Air Conditioning: Cooling systems, HVAC, temperature control for battery, cabin comfort.

Sustainability Engineering: Material recycling, life cycle assessments, emissions modeling, end-of-life considerations.

Service Types

Design & Conceptualization: Styling, functional design, system architecture.

Simulation & Analysis: CFD, FEA, thermal, crash prediction, virtual prototyping.

Prototyping & Testing: Physical prototype builds, component and system testing, durability, crash, environmental testing.

Software Development & Systems Integration: Embedded software, connectivity, electronics, sensor integration.

Validation & Certification: Regulatory approvals, safety compliance, emissions testing, safety auditing.

Materials Engineering & Lightweighting: Material selection, joining technologies, composite design.

After-Sales Engineering & Support: Warranty, updates, modifications, servicing, maintenance engineering.

Geographic Segmentation

North America: Strong OEM presence, high regulatory demands, advanced capabilities.

Europe: Emphasis on emissions, safety, environmental regulation, strong R&D.

Asia Pacific: Rapid growth in vehicle production, emerging EV markets, increasing demand for local engineering services.

Latin America, Middle East & Africa: Emerging opportunities, increasing vehicle adoption, but constrained by infrastructure and regulatory maturity.

Value Chain Participation

OEMs: Define requirements, oversee product development, manage platforms.

Tier-1 & Tier-2 Suppliers: Subsystems, components, modules, offer both engineering and manufacturing.

Engineering Service Providers / Consultancies: Specialize in niche or broad disciplines, provide design, verification, testing, software, etc.

Specialist Technology Firms: Sensors, AI & ML firms, software houses, materials innovators.

Regulatory and Certification Bodies: Set standards, audit compliance, provide safety/emissions certification.

Research Institutions & Universities: Provide R&D, materials research, novel technologies, training.

Customer Types

OEMs and Vehicle Manufacturers seeking full lifecycle support.

Suppliers needing to design components or modules for OEMs.

Startups / New Entrants, especially in EVs, mobility services.

After-market Players focusing on retrofits, software enhancements.

Government and Regulatory Agencies procuring test services, setting standards, infrastructure planning.

Given this scope, the potential for growth is expansive, though segmentation will matter: some areas will grow faster than others.

Market Size and Factors Driving Growth

To appreciate the scale and momentum of the automotive engineering services market, it is essential to examine both its approximate size and the key drivers underpinning its expansion. Below, we offer estimates, projections, and analysis of factors facilitating growth.

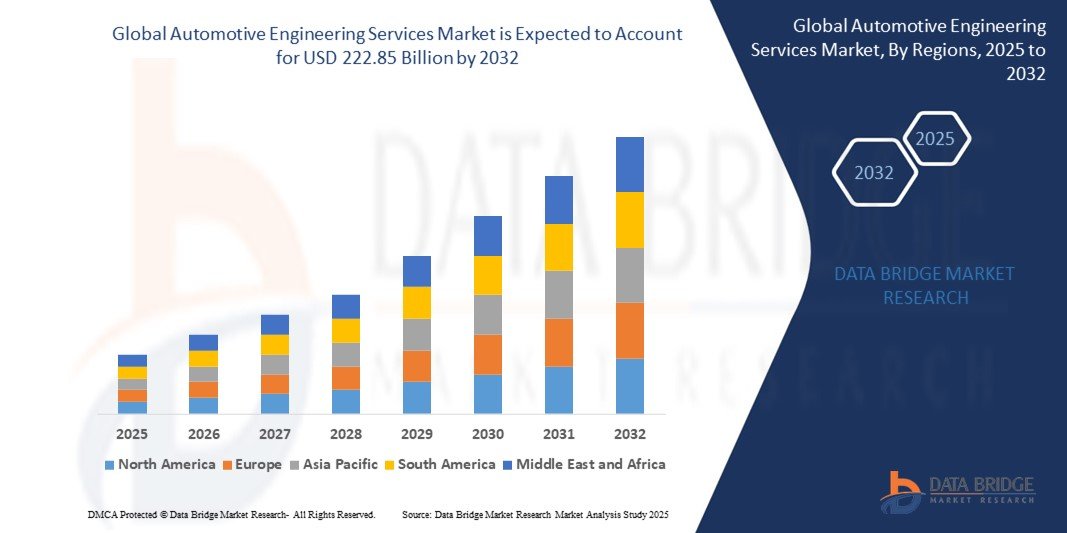

Market Size Estimates and Growth Projections

While precise numbers vary depending on definitions (for example, whether software services are included, or whether provision of testing and certification is fully accounted), the automotive engineering services market is substantial and growing. At present, the market is likely to be valued in multiple tens of billions of dollars globally. Over recent years, it has exhibited a healthy compound annual growth rate (CAGR), potentially in the mid-single digits to low double digits. Over the coming five to ten years, growth may accelerate, particularly owing to the shift toward electric and autonomous vehicles, software intensity, and stricter emissions/safety regulations.

For instance, should the EV and ADAS adoption rates continue their current trajectories, the market could grow to reach nearly double its current size within a decade. Similarly, engineering services connected to software, autonomy, and electrification are expected to see the fastest growth, outpacing more traditional services such as body design or purely mechanical component design.

Factors Driving Growth

Several interrelated forces are driving the automotive engineering services market forward. Because these forces operate in concert, they amplify each other, leading to strong momentum. The key growth drivers include:

Regulatory Pressure on Emissions, Safety, and Fuel Economy

Governments around the world are enforcing stricter standards for vehicle emissions (CO₂, NOx, particulate matter), fuel efficiency, crash safety, pedestrian safety, occupant protection, and more. To comply, OEMs must redesign powertrains, reduce vehicle weight, improve aerodynamics, and integrate safety technologies. Consequently, engineering service providers that can help with these improvements are in high demand.Electrification and Alternative Powertrains

The global shift toward electric vehicles, hybrids, plug-in hybrids, and hydrogen fuel cell vehicles requires new engineering competencies. Battery systems, electric motors, power electronics, charging infrastructure, energy efficiency, thermal management—all of these create large demand for engineering services.Autonomous Driving and Advanced Driver Assistance

As ADAS features proliferate (lane-keep assist, blind-spot detection, collision avoidance) and autonomous driving ambitions increase, OEMs require vast amounts of engineering support. Sensor fusion, perception, mapping, decision-making algorithms, redundancy, safety assurance, and testing of autonomous systems drive growth.Software and Connectivity Demands

The modern vehicle is increasingly a software platform. Connectivity, infotainment, over-the-air updates, cybersecurity, user experience, and in-vehicle digital services are becoming expectations rather than luxuries. Engineering services in software development, embedded systems, cloud integration, and data management are increasingly essential.Lightweighting and Materials Innovation

Because weight reduction improves fuel economy and EV range, light materials, composites, aluminum, high-strength steel, multi-material joining, and advanced adhesives are more widely adopted. Engineering services that specialize in materials selection, joining technologies, structural and crash engineering benefit.Consumer Demand for Features and Experience

Customers expect modern features—autonomous capabilities, digital cockpits, enhanced safety, customization. As features increase, engineering complexity grows. OEMs and suppliers rely on specialized engineering firms for speed, innovation, user experience design, and feature validation.Cost Optimization and Time-to-Market Pressures

Automakers face intense competition and tight margins. Speed in development, minimizing recalls, reducing warranty costs, optimizing supply chains, and adopting agile development processes are crucial. Thus, engineering services that can deliver cost-efficient, high-quality, fast solutions are rewarded.Globalization and Outsourcing

OEMs and Tier-1 suppliers often outsource aspects of engineering—design, software, simulation, testing—to regions with favorable cost structures. At the same time, many engineering firms establish regional presence to be close to clients and reduce lead times. This global dispersion opens markets and competition.Investment in R&D and Innovation

Both OEMs and engineering service providers are investing in R&D to keep ahead of technology curves. Whether in materials science, battery chemistry, AI/ML, or autonomy, innovation is critical. Public funding, private investment, and strategic partnerships all contribute to this driver.Sustainability and Environmental Concerns

Increasingly, vehicle manufacturers and consumers care about lifecycle emissions, recyclability, sustainable materials, and green manufacturing. Engineering services that offer expertise in eco-materials, lifecycle assessment, carbon footprint reduction, and end-of-life recycling support are in greater demand.Urbanization, Mobility Trends, and New Business Models

Trends such as shared mobility, ride-hailing, micro-mobility, vehicle-as-a-service, and autonomous ride-sharing influence vehicle design and engineering needs. These new business models pressure vehicle architectures, feature sets, durability, maintenance, and total cost of ownership. Engineering service providers must adapt.

Future Outlook

Because of these drivers and trends, the future of automotive engineering services appears robust. Moreover, several expected developments will likely reshape the market further.

Shift Toward Software-Defined Vehicles

Vehicles increasingly will be architectures in which software, rather than mechanical design, plays primary role. This shift implies that much of the value of the vehicle will derive from software updates, digital services, and feature bundles. Engineering services will, therefore, tilt heavily toward software, electronics, connectivity, cybersecurity, user experience, and data ecosystems.Modular and Scalable Architectures

OEMs are moving toward modular platforms that can support multiple powertrains and body styles. These allow economies of scale, faster introduction of variants, and reduced development cost. Engineering service providers will need to master scalable architectures, platform engineering, modular design, and flexible integration.Growing Role of Virtual Development and Testing

Digital twins, virtual validation, simulation of complete vehicle behavior, and scenario-based testing will reduce reliance on physical prototypes. Because of that, engineering service providers with strong capabilities in simulation, modelling, hardware-in-loop (HIL), and software-in-the-loop (SIL) will gain advantage.Sustainability, Circular Economy, and Green Engineering

Material recycling, reuse, lighter vehicles, lower emissions across vehicle life cycles, and sustainable manufacturing will become standard expectations. Engineering service providers that integrate environmental metrics into design from the start will be preferred.Expansion in Emerging Markets and Localization

As vehicle production increases in regions like Asia, Latin America, and Africa, engineering services will follow. Localization of engineering centers, supply-chain co-location, knowledge transfer, and region-specific regulatory and consumer requirements will become more prominent.Cross-Industry Convergence

Collaboration with tech industries (AI, cloud, sensors), energy industries (battery, charging infrastructure), telecom (connectivity, 5G/6G), and software ecosystems will intensify. Engineering service firms will form partnerships, M&A may increase, and service portfolios will widen.

Conclusion

To conclude, the automotive engineering services market stands at a crucial juncture. On one hand, emerging technologies such as electrification, autonomy, advanced connectivity, and sustainability are creating enormous opportunities. On the other hand, challenges such as regulatory complexity, talent shortages, high validation costs, cybersecurity threats, and market unpredictability must be addressed proactively.

Nevertheless, firms that can adapt—by building software and systems integration capabilities, investing in simulation and virtual testing, embracing modular architectures, ensuring regulatory compliance, and offering sustainable engineering—will likely thrive. Over the next decade, the market is expected to expand significantly, both in size and in scope, with segments like EV powertrains, ADAS/autonomy, software/connected services, and sustainability engineering leading growth.

For stakeholders across OEMs, suppliers, engineering service providers, startups, and regulatory bodies, the message is clear: invest in future-oriented capabilities; build agility; foster collaboration; anticipate regulation; and place sustainability and software at the heart of engineering. In doing so, the automotive engineering services market will continue its evolution, delivering innovation, performance, safety, sustainability, and value to consumers and society alike.